A bright spot in a dim economy

We initially wanted to write about the losses faced by Nigerian companies due to the Forex saga but decided that we have had enough of that.

So we looked for and found good news 😀

Aruwa Capital recently released an article on the growth of private equity exits in Africa.

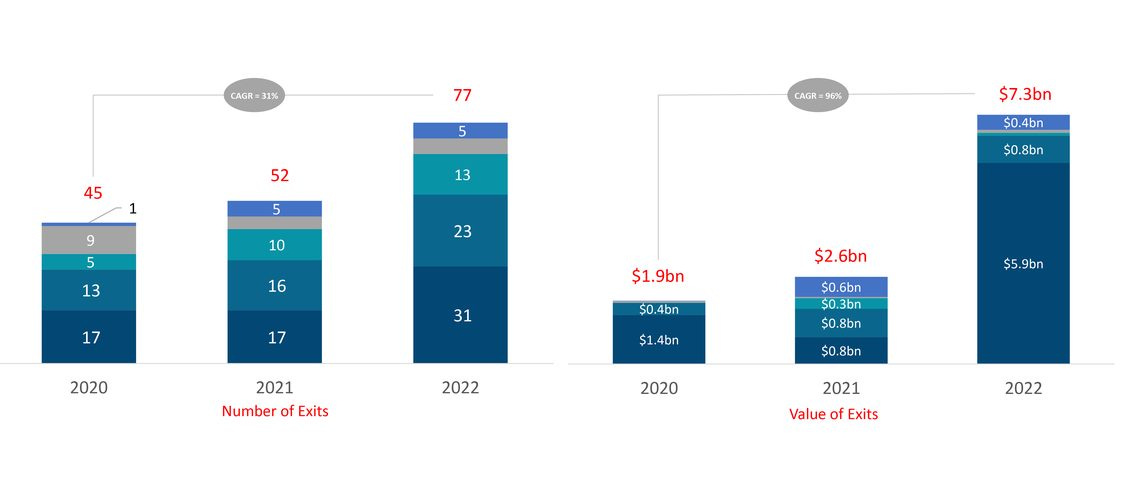

According to their research, there have been 77 deals in 2022, a 71 per cent increase in the number of exits on the continent between 2020 and 2022. The total value of those deals was 7.3 billion US Dollars a 3.8x increase on the 2022 value.

The growth has been driven by both financial and strategic buyers, with strategic buyers accounting for 48 per cent of all exits.

Source: Global Private Capital Association(GPCA), Aruwa Capital Analysis

So what?

The primary purpose of private equity funds is to provide returns to their funders (Limited Partners or LPs). Therefore, the entire point of their investing in a firm is to sell it at a profit.

But the African market has an issue. The capital markets (think stock exchange) where these funds usually go to sell their investments are not always ideal because of the small pool of investors that participate in African stock markets. So funds have to find innovative ways to exit their investments.

This is why the news that they are having increased sales success is good. It means they can recoup their investments. However, one thing that caught our eye is the number selling to strategic buyers. A strategic buy is when a company that operates in an industry buys a firm operating in the same industry to expand the buyer's operations.

One issue that is popular in the Private Equity industry is the game of hot potato. Where one fund buys a company, then sells it to another fund then that fund sells it again. Usually, at each step, the company in question is loaded with more and more debt until it goes bankrupt. So when a strategic buy happens, it is generally great for the company and the economy.

This growth is welcome and we hope the momentum is not lost.

Link to the full article