A moody downgrade

Outlook on Nigeria's fiscal future just got more depressing

Nigeria got another downgrade from B3 to Caa1. Similar to getting a D on that math test. Well the country has witnessed two consecutive downgrades from B2 to B3 last October and now from B3 to Caa1 this January.

Don’t get too lost, we are talking global credit ratings. The global risk assessment firm, Moody's, has reduced Nigeria’s credit rating once again and there are several but related reasons for this. The agency expects the government’s debt and fiscal position to worsen, and the CBN has been violating its own act by over lending in terms of ways and means.

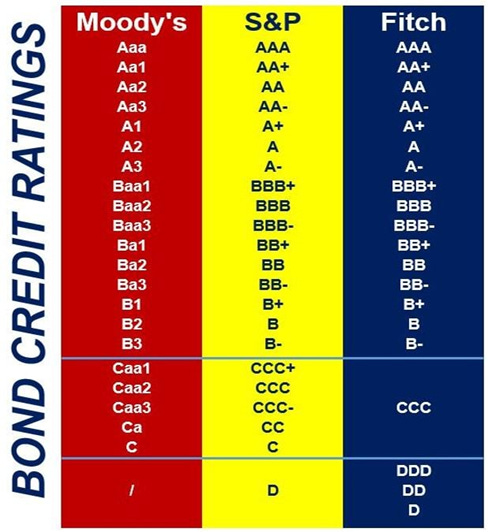

To put this in a better perspective, here’s a picture showing all ratings on a scale.

The previous rating of B3 was worrisome enough. Now, the country has a credit rating that is considered to mean a poor standing and subject to high credit risk; a step deeper into junk bonds. Junk bond rating (Ba1 and lower) simply means that there is greater likelihood that the issuer will default on the bond unlike investment grade bond ratings (Aaa to Baa3).

Let’s not forget that the government’s budget plans for 2023 heavily rests on larger fiscal deficits than the previous year. This coupled with the fact that the country’s institutional capacity to formulate and implement a fiscal repair strategy is not strong enough contributes to the driver behind the downgrade of the credit rating.

After the news of the rating downgrade, government bonds have seen a great fall with longer-dated bonds down the most. Dollar denominated 2051 Eurobonds fell by more than 2.6 cents to 69 cents on the dollar.

So what?

The new credit rating could raise the cost of borrowing for the country in international markets and can also trigger further decline in ratings by other agencies. The country’s low revenue and high debt position reflects a situation of poor economic health, the rating does not just affect the country but the businesses operating within the country and investor confidence in the Nigerian bond market. In plain English, the risk of dealing with Nigeria as an economy, is getting higher. Borrowing for Nigeria and companies in Nigeria has just gotten more expensive as a result of the downgrade.