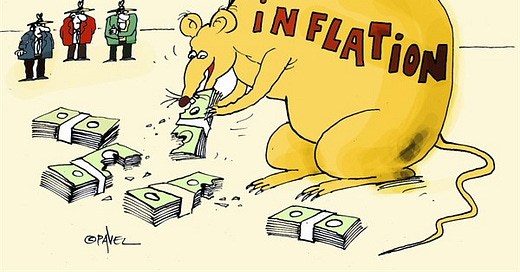

Imagine going to a store with a pocketful of money, excited to buy your favorite treats, only to discover that the prices have skyrocketed since your last visit. This scenario is an ongoing challenge for many African countries. Inflation, the steady increase in prices over time, is the money monster eating deep into people's money.

Before we embark on our journey, let's first understand what inflation is. Inflation is like a sneaky thief that silently erodes the value of money. When prices rise, the purchasing power of money decreases, meaning you can buy fewer things for the same amount of money.

Several things can lead to inflation including when the demand for goods and services exceeds the available supply, in this case prices tend to rise. In some African countries, rapid population growth, coupled with limited production capacities, can create this gap between demand and supply, causing inflation.

A country's currency losing value against other currencies can cause inflation. Many African countries rely on imports for goods and raw materials. If their currency loses value, it becomes more expensive to import these items, leading to higher prices.

Other times, inflation is as a result of government policies. For example, excessive government spending or printing too much money to fund projects can flood the economy with cash, leading to increased demand and then higher prices.

Also, we should consider external factors. For instance, fluctuations in global commodity prices, such as oil or agricultural products, can directly affect prices within nations, as they heavily rely on these sectors.

Inflation doesn't discriminate; it affects everyone. It's harder to afford goods and services, the uncertainty of prices affects planning for both people and businesses, money saved loses value and what not.

To beat this monster, governments and central banks try various means like regulating government spending and interest rates or even a reform of the economy's structure.

To learn

Let's go fun fact way!

One of the most notable examples of inflation in Africa is Zimbabwe's hyperinflation crisis in the late 2000s. The country experienced an astronomical inflation rate, reaching an estimated peak of 79.6 billion percent in November 2008 and a daily inflation rate of 98%. Prices were doubling every day. A major cause of this was monetary mismanagement, political looting that crippled the banking sector and the government printing way too much money.

After this nightmare, the government adopted the US dollar and ceased printing money, this helped bring down inflation until in 2019 when they reintroduced a new Zimbabwe currency that brought back hyperinflation. Indeed, the inflation rate was 417.25% inflation in October 2020. Guess they weren’t structurally ready for that yet!