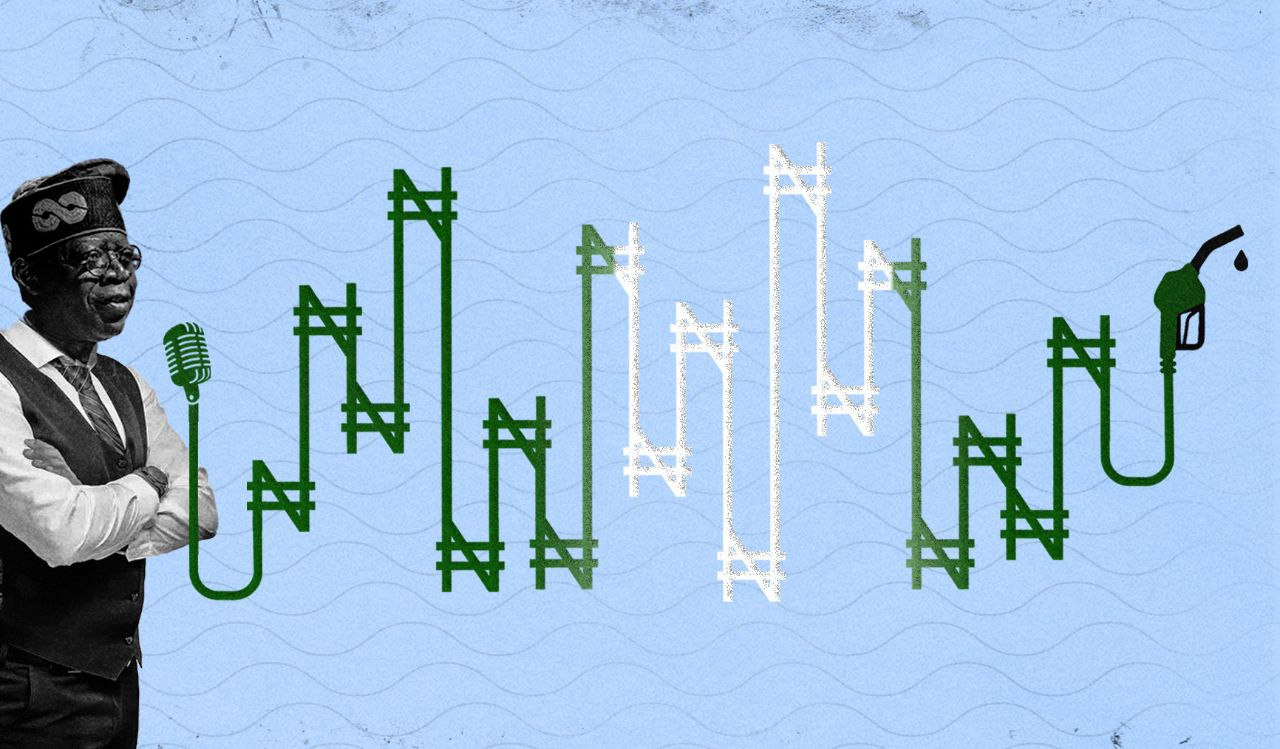

Uncle T's in town

Policies from the new administration #fuel subsidy removal

On Monday 29th of May, Bola Ahmed Tinubu was inaugurated into the office of the President of the federal republic of Nigeria and he definitely hit the ground running (iykyk).

There are so many things to unpack at the same time.

Let’s talk subsidy removal

Fuel Subsidies were introduced in the early 1970s to buffer the shock in oil prices. From then on, subsidies became a consistent allocation in the Nigerian budget, until the government could not shoulder the weight of this allocation anymore.

Some weeks ago, it was revealed that the government had borrowed a certain amount to cushion the impact of the subsidy removal but then they went back on this policy. One of the key agendas of this new administration was the removal of the subsidy, so although the removal seems harsh, it should not be a surprise as it is consistent with the administration's objectives.

It is noteworthy that the policy of fuel subsidy, although important, was never meant to be a permanent fix. The subsidies can be viewed as a means to an end, the subsidy introduced attempted to buffer the impact of high prices on the economy based on the populace's standard of living. So, with that in mind, during the period subsidies were being paid, policies should have been going hand-in-hand to affect the standard of living of individuals, the health sector, education sector as well as creating alternate transport systems. So, when the temporary subsidies are removed at a later date, the effect on the average Nigerian is not so heavy.

With the subsidy removal, prices of goods and services in the economy would begin to capture the actual value of fuel prices as transportation of goods and services key components of determining the prices of goods and services in the economy.

The impact on Nigerian households would affect economic welfare in the long run. When an average Nigerian earns the minimum wage which may or may not be considered a ridiculous amount given the inflation rate of the economy, he is unable to afford basic items. Food produce becomes hiked; the cost of transportation increases and all these would still be covered by the “minimum wage”. Not so feasible.

The impact on businesses seems more grievous as almost all activities of businesses are dependent on fuel. It consistently seems that the Nigerian government continues to do things that make the business environment not conducive for businesses to thrive, if it is not an increase in company taxes or value added, it is an increase in interest rates that affect acquiring loans or the stringent procedures for getting loans. Now as the icing on the cake, the removal of subsidies. An increase in fuel increases operational costs because most times, businesses would then shift the increase to customers. So, prices increase, but do consumers have the purchasing power that meets this price increase? So, this means that businesses are spending a lot to create goods and services, but the revenue is not growing at the same pace.

In the long run, economic growth may reduce. In the last week of May, the Nigerian Bureau of Statistics released a quarterly report on the economy’s Gross Domestic Product. The value for the first quarter stood at 2.31% and when compared with the previous year’s Q1, it showed a decline. This they attributed to the cash crunch that happened in the earlier quarter of the year and also the impact of the election activities on businesses. One would think that with this value, the government would be setting structures that would improve the value in this 2nd quarter, but this fuel subsidy removal comes as a blow to a reviving economy. Also, the inflation rate is likely to increase from the current rate to a higher value which is not good news. This is because transportation prices would hike prices of goods and services, and these are components of the basket of goods that determine inflation rate. Let’s just hope that with this increase, our very own Meffy does not employ his quick-fix solution (talking interest rates) because that solution may not cut it out this time.

Apart from fuel subsidy removal, another agenda of this new administration is to collapse all other exchange rate systems and merge them into one. The CBN has its official rate, a rate that exists for the export system and then the black market. The question now would be, is it a total merger or just an adoption of an exchange rate system that is determined solely by the forces of demand and supply or a fixed exchange rate system where the central bank pegs and sets the official rate. Total reliance on a floating exchange rate may remove the existence of a black market system in the economy and also solve the issue of arbitrage but we are yet to see the finalized decision.

P.S: The masses need to give Tinubu a name, kind of like how Buhari is aka Bubu and Emefiele is aka Meffy. You can drop your suggestions in the comments!

Let’s hear from you on the new administrations policies too!

I'm surprised meffy is still in this conversation seeing how 'Bubu' just suspended him

Technically Tinubu is still a Bubu lol